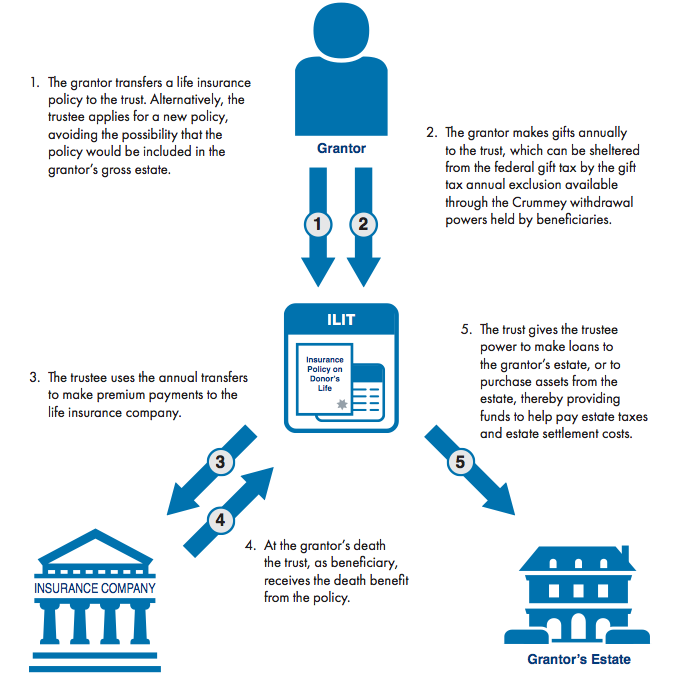

An irrevocable life insurance trust (ILIT) is a trust that cannot be rescinded, amended or modified in any way after its creation. They are set up with a life insurance policy as the asset owned by the trust. Once the grantor contributes property or life insurance death benefits to the trust, he or she cannot change the terms of the trust or reclaim any property left to the trust. There are a few good reasons to use this type of arrangement rather than naming an individual beneficiary, including taxes, asset protection, and ensuring benefits are used in a manner that the benefactor sees fit.

Why Use an Irrevocable Life Insurance Trust?

An irrevocable life insurance trust is often used to set aside assets for certain purposes, such as to pay estate taxes, since these assets themselves are not taxable. In order to do this, the selected assets must be moved into the life insurance trust at least three years before they are used. Sometimes people will create a new policy in a spouse's name to get around this requirement.

There are three good reasons to utilize an ILIT. The first is for estate tax considerations, the second is for concern of leaving a large sum of money unsupervised to a minor or an irresponsible adult, and lastly, for asset protection concerns.

If an ILIT is properly structured, the death benefits paid to the trust will be free from inclusion in the gross estate of the insured. This is different from when life insurance death benefits are paid to an individual, as the proceeds are included in the taxable estate of the decedent.

If the insured has beneficiaries who are minors or adults who have had issues in the past, such as alcohol or drug abuse, or problems handling their finances, it might be a good idea to set up an ILIT with the trust as beneficiary. This appoints a trustee to act as a supervisor for the trust and distribute the assets per the terms of the trust documents per the grantor's wishes.

The ILIT will also provide a level of asset protection for the beneficiaries should they currently be involved in litigation or see the potential for a future lawsuit against them. ILITs are not considered to be owned by the beneficiaries, which in turn makes them extremely difficult for courts to attach as assets of the beneficiary, thus making them next to impossible for creditors to access.

There are drawbacks to using an ILIT, so the decision to do so should be made carefully. Changes to an ILIT can only be made by the beneficiaries, so the benefactor loses control of the assets before death. Also, while ILIT assets are not taxed as part of the estate, they are taxed as part of the beneficiaries' estate, leaving a bigger tax burden to their descendants.

This information is not intended to be tax or legal advice, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to seek tax or legal advice from an independent professional advisor.